In an attempt to answer these questions, we have analyzed several open data sources from the European Commission to identify the strategic priorities for the future beyond 2020. Leading the race are Nuclear fusion, graphene, supercomputing, autonomous cars, sustainable transportation, advanced healthcare, and energy security.

As part of our effort to stay in touch with the forefront of innovation in the intersection of finance and technology, we have examined 25 years of European funding of innovation from the program FP4 (starting in 1994) to the most recent Horizon 2020.

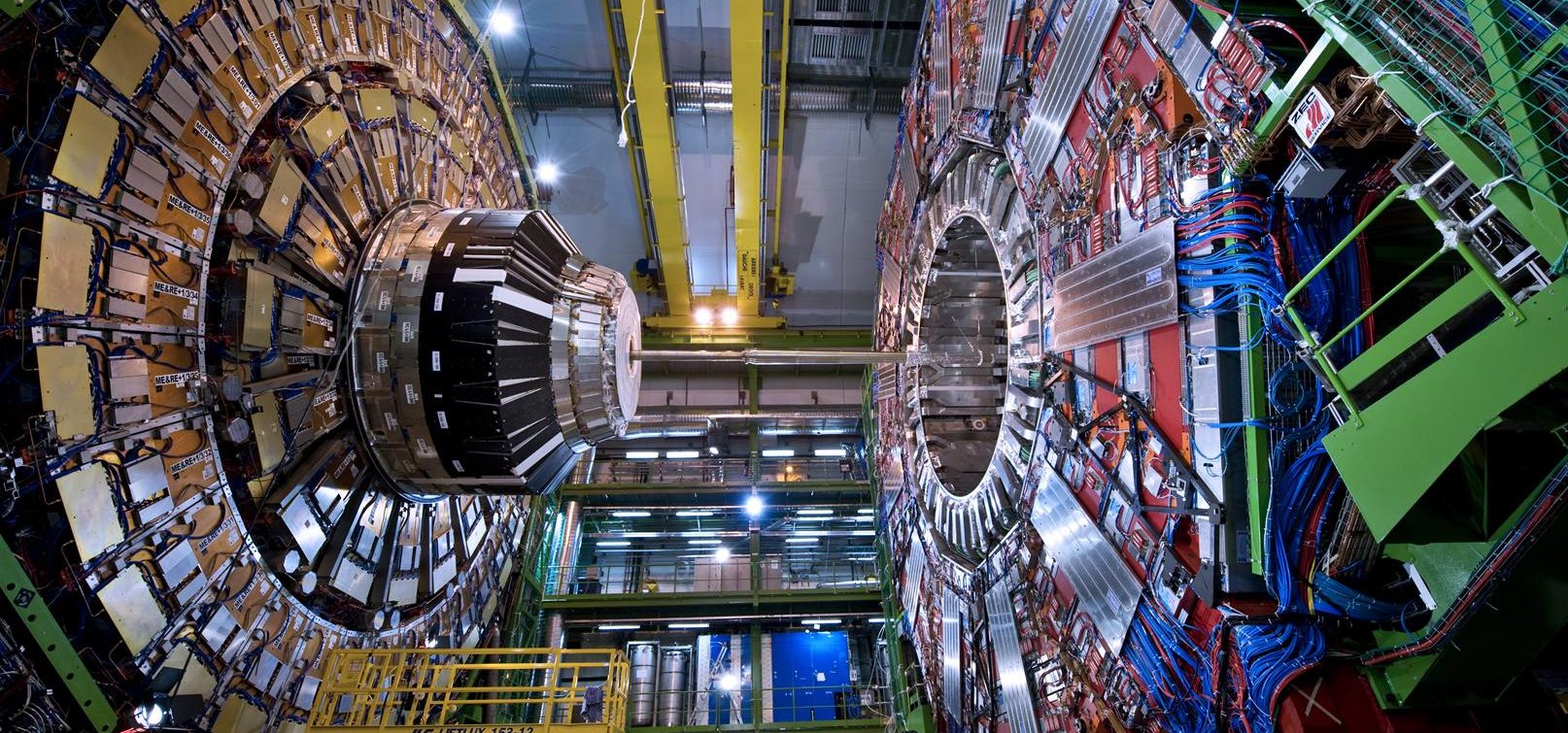

Just by looking at the largest amounts invested in projects of the H2020 funding scheme we can see that nuclear fusion, graphene, artificial intelligence, and biomedicine are the main priorities for the European Union. A breakthrough in any of these will have a great impact on multiple industries and sectors, including finance and data processing.

In more than half a century the European Union has grown to 28 countries united by common borders, trade, investment and, also, by a research strategy. However, the involvement in research and innovation at European level is different depending on the prevailing organization’s type, the amount of funds allocated or the topics funded.

The data shows thousands of projects that have cross-border participants with a increasing participation of for-profit private organizations, which most of the times partner with academic institutions as coordinators. Universities are also big players, leading the coordination of projects since 2007 especially if we measure them by funds granted.

The United Kingdom is one of the leading players both as a coordinator or a participant in research projects. Germany, France, Spain, Italy and the Netherlands are also leaders in the field of research and innovation in the European Union, while others non-members, such as Switzerland or Israel play important roles as participants.

The European Union has raised the bets on clean energy, with nuclear fusion and transportation fueled by hydrogen as alternatives to a carbon-based society. In the engineering of materials, the EU is moving to lead in graphene, a potential game-changer in aeronautics, space, computing or health care. Biomedicine and medical research are also being push ahead with strong investments in the H2020 framework, while many of the project types were also supported during FP7. In previous frameworks other projects such as the European global positioning system, about to be completed with the last satellites put in orbit, where a priority.

Of all participants in FP7 and Horizon 2020 frameworks -regardless of the number of projects in which it participates- the majority are private companies (67.5%), followed by research organizations (10.3%), public bodies (6.8%) and higher or secondary education establishments (6.6%). The countries with the largest number of participating organizations during the last decade are Germany, the United Kingdom, and Spain, although the first positions vary according to the type of the entities. Germany and France stand out in the number of higher or secondary education establishments, while Spain and Italy are first in the participation of public institutions.

We have to take into account that we refer to unique entities. That’s why the number of private companies is oversized with respect to the total number of participation: in average, one public institution, research organization or educational entity participate in many more projects than private companies. In fact, if we take a look at the number of participants, the higher or secondary education establishments collaborate the most (36.8%), followed by private companies (30.6%) and research institutes (23.7%).

In the same way, research organizations of the Horizon 2020 framework manage the largest amount of funds. The CNRS (Centre National de la Recherche Scientifique) accounts for more than 550 million euros, while the private entity with the highest allocation, Siemens, leads its category with nearly 50 million euros. In Spain, CSIC (Consejo Superior de Investigaciones Científicas) leads by participating in projects that aggregated 161 million euros, and the private entity Atos, S.A., with 45 million euros.

On the other hand, participant organizations in different projects can play different roles: the two prevailing ones are coordinator and participant. The most common is one entity coordinating one project while other entities -in some projects are many- are integrated as participants. If we take a look at the accumulated data from last 25 years, Italy is the country with the highest percentage of participant role collaborations, while in the United Kingdom one in four projects were carried out in the form of coordinator. In absolute figures, German entities have participated the most while, although Italy exceeds Spain in total, the latter has played a coordinating role more times.

This analysis was possible thanks to the commitment to transparency of the European Union. We support open data initiatives that enrich the way we analyzed and understand the world.