Personalizing Banking Services with Advanced Data Analytics

In the traditional banking model, data was produced by the customer and processed by data analysts. Customer’s income and expenses were used to understand global trends and design products and services attractive for specific segments.

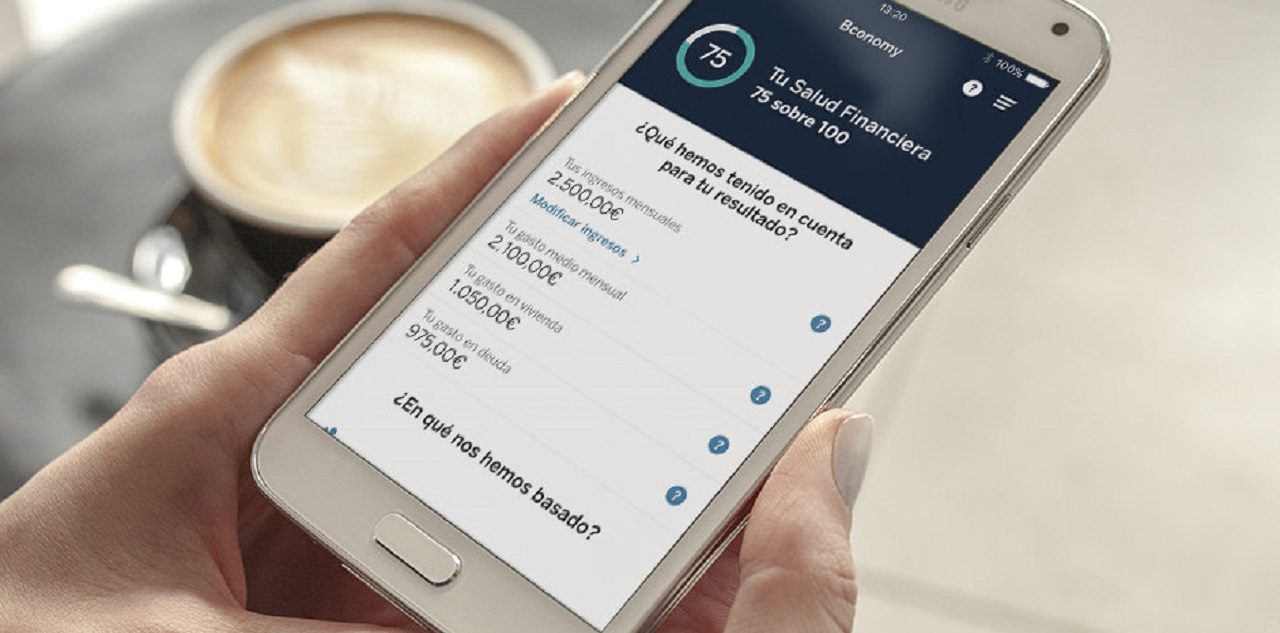

BBVA is leveraging advanced analytics methods and technology to give users full control over their data and help them understand their financial health to make better decisions. BBVA’s latest feature, Bconomy, is a financial health score (0-100) based on an analysis of the customer’s fixed and variable expenses and savings.

Bconomy is more than just one functionality, and it has been conceived to encompass other existing tools that BBVA has made available to the user, such as “My Day to Day”, “My Budget”, “My Objectives” and a newly added personal benchmarking tool called “Compare yourself”, gives customers the tools to take better financial decisions based on their own data.

All existing tools transform data from different BBVA’s databases to give the user more capacity to control their finance. Gonzalo Rodríguez, BBVA Digital Transformation Director, explains that this tool will help clients to save money and face unforeseen expenses. Elena Alfaro, BBVA Head of Data and Open Innovation, highlighted that “the smart use of data brings personalization and relevance and enables better decision making, which will ultimately help customer manage their resources more effectively.

BConomy Components and Data Sources

We briefly provide an overview of the analytic components behind Bconomy.

- Finance Scoring: The scoring is based on an analysis of transactions, and uses a standard formula to assess the performance of a customer’s finance. The formula estimates that a maximum of 50% of the expenses should be for fixed expenses, such as home rental or electricity; 30% for variable expenses and 20% for savings.

- Transaction categorization: This text analytics tool, included in the functionality “my day to day”, is powered by the categorization engine developed at BBVA Data & Analytics, which uses a set of big data technologies to process daily millions of transactions, classify them and enrich them with category labels. The categorization taxonomy includes 15 major categories with 72 subcategories. Read more here. The engine processes a total of 7M transactions every day, four from account movements and three from credit card transactions.

- Sociodemographic Benchmark: This component allows the user to compare their finance performance with other customer with similar sociodemographic profiles. The engine leverages aggregated and anonymized data that is presented to the user as a personal dashboard.

BConomy is part of other efforts at BBVA to help customers better understand their expenses and be more efficient at their finances. For example,during summer, BBVA launched “Expected Transactions”, the forecast of customer’s financial movements for the coming months in a glance. This feature is now available as part BBVA’s Personal Finance Manager (PFM) called “My Day to Day”, which is currently used by 1 million clients each month.The core algorithm, its forecasting engine, was developed by BBVA Data & Analytics using Big Data tools like Apache Spark and implementing a combination of Machine Learning algorithms for time series forecasting. It is another example of how BBVA Data & Analytics applies Data science to improve the financial life of BBVA clients by providing useful information to take decisions. If you want to find out more, we invite you to watch this video