The creation of BBVA’s Data area in 2017, coupled with the launch of the AI Factory three years ago, have been two clear milestones in the bank’s commitment to data and technology that began more than a decade ago. Especially the last few years, BBVA has focused on the increase in capabilities for the creation of products based on Artificial Intelligence.

“In the last three years, we have increased our strategic data projects sevenfold, and our plans are to be managing more than 500 new initiatives by 2023,” says Ricardo Martín Manjón, Global Head of Data at BBVA. To achieve all these goals, the AI Factory’s successful model will be exported to Mexico to continue promoting the development of new analytical products.

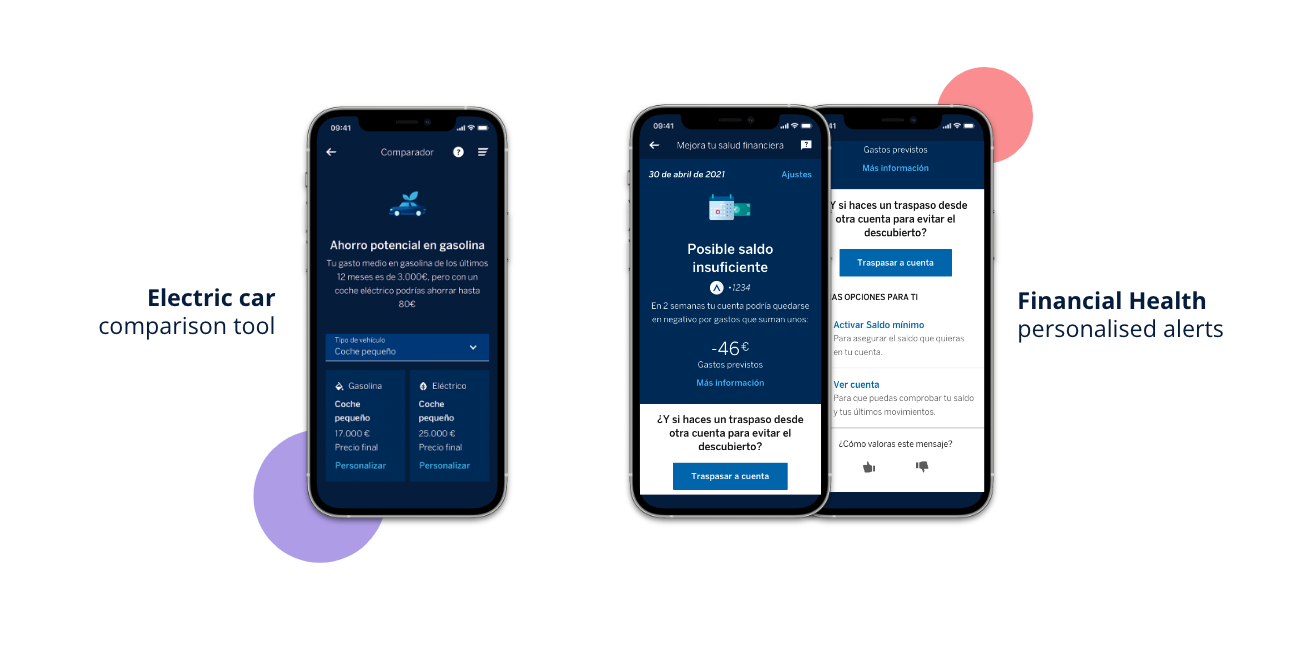

Currently, there are 12 Financial Health app functionalities whose analytical models have been developed in the AI Factory, including services for automatic classification of expenses into different categories or the visualization of digital subscriptions, such as Netflix or Amazon Prime; or gas and electricity supplies. These services generate up to 40 personalized alerts that, for example, warn of a higher-than-usual bill, account overdrafts or offer suggestions for saving and creating a financial cushion.

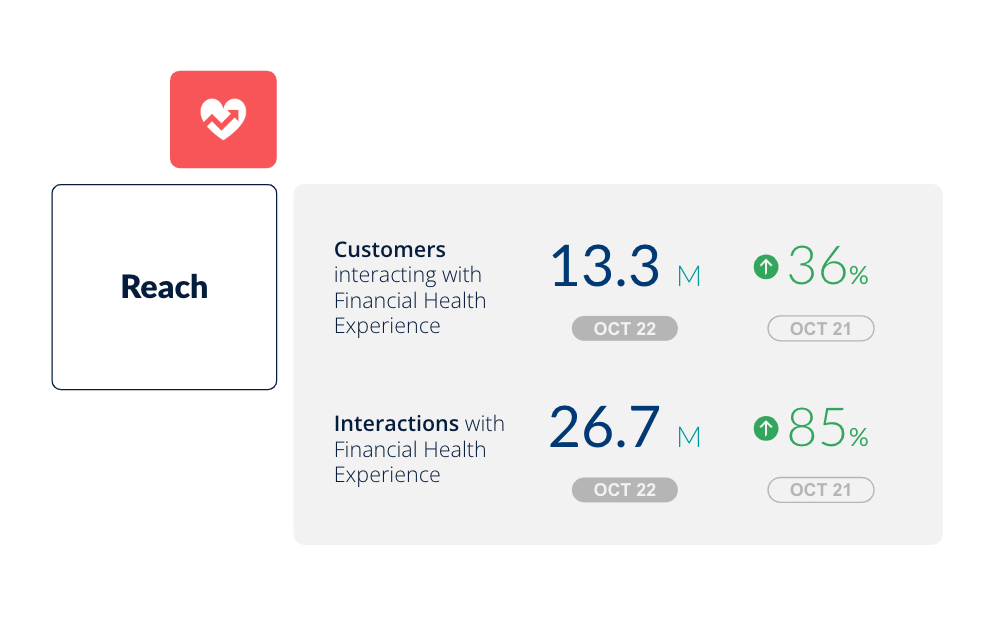

BBVA has its Financial Health tools operational in Spain; and they are gradually being deployed in Mexico, Turkey, Peru, Argentina and Colombia. Each month, they are consulted by more than 13 million users, 36% more than in 2021; and they register almost 27 million interactions, 85% more than the previous year. “These services, developed with BBVA’s own technology, are a differentiating element that gives the bank a competitive advantage over the peers” says Martín Manjón, who recalls that these services have a direct impact on customer satisfaction, since those who use the Financial Health tools recommend BBVA more than non-users.

Another of BBVA’s great data-based services focuses on sustainability. Thus, BBVA has developed several services that show the energy consumed, the costs associated with the mobility of customers or the carbon footprint for both individuals and companies. One of the latest innovations in this regard has been the new sustainable car calculator, a tool developed by Madiva Soluciones within the AI Factory, which allows customers to see the costs associated with the purchase and maintenance of an electric car versus a gasoline-powered one.

This line of work will incorporate similar functionalities to analyze the savings that can result from the adoption of solar power solutions or recharging points at home, using the user’s actual energy consumption data.

From BBVA AI Factory we continue working on the bank’s Data Big Bets. Now, with a new member in the family. ¡Bienvenido México!